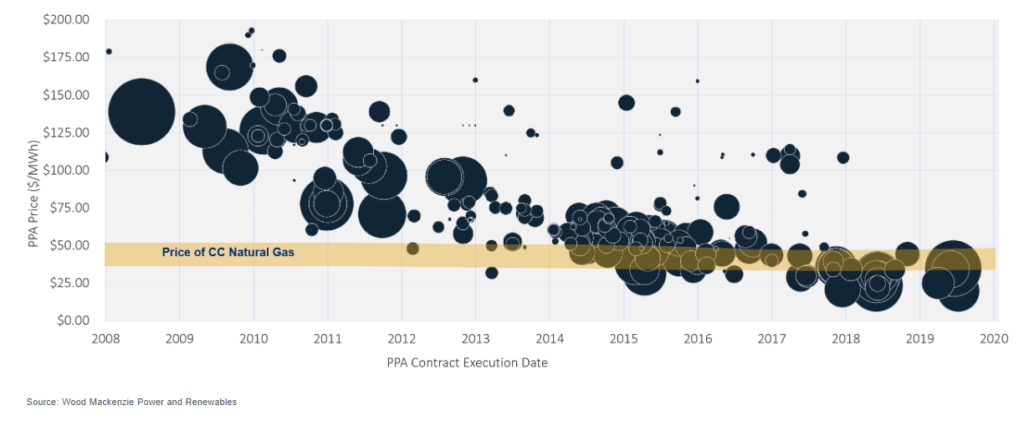

The news tells us solar is cheaper than ever. According to Wood Mackenzie Power and Renewables, pricing for solar power purchase agreements (PPAs) has ranged between $19 and $42/MWh for contracts signed over the past 18 months.

But what does that really mean? What really impacts this price? There are several factors that impact energy prices for PPAs.

Locational Marginal Price

In the first place, the Locational Marginal Price (LMP), reflecting the marginal cost for electricity at various points across an electric grid. This price accounts for patterns of load, generation, and limits of the transmission system within a specific geographic area. The price of natural gas is highly correlated to the price of energy because elevated electricity prices raise demand for natural gas, which often results in higher natural gas prices. Weather extremes impact the LMP market by increasing electricity demand and resultant LMPs.

When Over-the-Counter futures block prices (such as ICE) decrease, it is a direct representation of change in view for future LMPs reflective of a buyer’s willingness to hedge their load or the willingness of generator to hedge their output, rather than a forecast for future LMPs. Future LMPs are driven by weather, the economy, generation, fuel prices, and regulatory policy from entities like PJM, FER and NERC.

Wind vs. Solar PPAs

Furthermore, wind PPAs serve as an alternative to solar PPAs as a way for corporate and industrial customers to reach their sustainability targets and renewable energy commitments. Wind has been dominant in PPAs to date due to its scalability and comparably lower price, but there may be signs that solar is gaining ground. As the Production Tax Credit for wind sunsets, costs for development with less predictable delivery may slow wind development. Increasing predictability in solar supply will enhance stability, particularly with major strides made in battery storage. The resurgence in solar procurement is being driven in the short term by the foreseen stepdown of the Investment Tax Credit, and in the longer term by the adoption of solar PPAs by technology and data firms.

Perception as Reality

Lastly, PPA announcements receive a lot of attention in the media. However, the lack of transparency in these deals can make it very difficult to compare projects on a level basis. Further, industry analysts tend to collect their data from the same source, repeating numbers in a seemingly infinite number of outlets. Additionally, data platforms are often cryptic about whether they cite executed prices or merely “offer” or “open interest prices” from developers in the marketplace. This can easily skew market data.

Eventually, this pricing data creates competition among developers and ultimately drives prices down and shapes a reality for prospective buyers. In fact, in a recent survey conducted by LevelTen, developers ranked competition from other projects as the number one factor accounting for the decline in pricing.

These are only a few of the myriad factors that influence a contract price for energy. Ultimately, for a PPA, the two parties must align on location, RECs, credit/collateral, risk management and financing.

If you’d like to learn more about PPA pricing and contracting or keep receiving articles like this, let us know!